This article will focus on comparing a long put versus a vertical put spread.

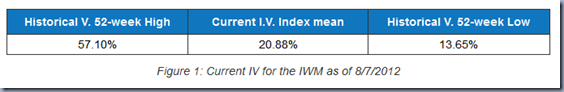

In a recent Options class at our Minnesota center, we looked at the general market and noticed that it was approaching previous supply zones. Based on past price action performance, we forecasted that there was a high probability that the markets might fail to break to the upside and consequently roll over. So next we looked at the (I.V.) implied volatility of IWM, the exchange traded fund that tracks the Russell 2000. After checking out the current I.V. reading against its 52 week historical volatility high and low, the conclusion was made that the majority of the Exchange Traded Funds (ETFs) that are tracking the general US market low I.V.

Low I.V. means that we should be a buyer of options. The fact was that I.V. was not necessarily at its lowest reading but just inside its lowest range, which means that we could do either a simple option strategy such as a long put or a more complex strategy such as a vertical put spread.

PART I: A Long Put

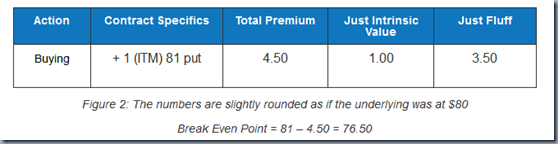

Before we explain how the more complicated vertical put spread works, we will go slowly over the long put. Figure 2 below breaks down a put option into pieces.

At the time, the IWM was trading at $79.94 per share, with resistance right above that.

The selected long put will expire in November after the election on the 3rd Friday. The logic for going that far out is that time decay is not as rapid on a longer term option as it is when a front month option is bought. The strike selection 81 means that the option contract at the time of purchase had a whole dollar of intrinsic value, while the 3.50 extra was the price for the time value. Those three and half points of fluff, extrinsic value, will be gone at expiration if the stock stays where it is. However, that is not the reason why we bought the option. The put option was purchased because we forecasted that IWM will roll over much sooner than expiration. Nonetheless, a long option, in this case a put, is a decaying asset and the mere passage of time works against us. If the IWM does not roll over, then every single passing day during the upcoming months, our option premium will lose its value. One thing is certain when trading options – time value will eventually go out of them. To overcome this disadvantage, we need to turn the tables around: hence, a vertical put spread is the correct choice.

PART II: A Vertical Put Spread (Debit Spread)

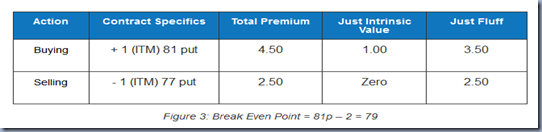

This strategy is also known as a Bear Put and involves the simultaneous buying and selling of puts at the different strike levels. In our case, the stock was sitting near its supply zone, which was coincidentally a round number. Our technical analysis told us that there was resistance above this. We chose to buy the 81 put and the next logical thing is to forecast how far down the IWM might go. There is virtually no chance that the Russell 2000 ETF would go down to zero, so realistically speaking we located the first level of demand around 76. Hence the idea was to sell the 76 put strike price because most likely the price will not puncture through 76 at the first try. Hence, the vertical put spread was built in the following way.

The first step, buying the 81 put is the same as the trade discussed above. But now there is a second step: selling the 77 put. When the math is done the cost of the trade is only a 2.00 debit to us, which is much better than what the cost of just the long put was. Also notice that the Break Even Point is now much easier to be reach. By selling the OTM option, the trader has received a discount in the amount of the premium sold, 2.50.

Let us sum up by comparing the two breakeven points. The long put’s BEP is 76.50 while in the case of the spread trade, the BEP is 79, which is much easier to reach. Time decay still works against us in a spread but it is somewhat minimized. Spread trading is the way to go. Have a green trading.

Taken from: Online Training Academy.

No comments:

Post a Comment